- Harbourfront Quantitative Newsletter

- Posts

- Volatility vs. Volatility of Volatility: Conceptual and Practical Differences

Volatility vs. Volatility of Volatility: Conceptual and Practical Differences

Volatility of Volatility Explained: How It Differs from Traditional Volatility

Volatility and volatility of volatility are highly correlated and share many similar characteristics. However, there are subtle but important differences between them. In this issue, we will examine some of these differences and explore an application of volatility of volatility in portfolio management.

In this issue:

Latest Posts

Modeling Gold for Prediction and Portfolio Hedging (13 min)

Effectiveness of Covered Call Strategy in Developed and Emerging Markets (13 min)

Identifying and Characterizing Market Regimes Across Asset Classes (13 min)

The Role of Data in Financial Modeling and Risk Management (13 min)

Volatility Risk Premium Across Different Asset Classes (13 min)

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Improving Portfolio Management with Volatility of Volatility

Managing portfolios using volatility has proven effective. Reference [1] builds on this research by proposing the use of volatility of volatility for portfolio management. The rationale behind using volatility of volatility is that it represents uncertainty.

Unlike risk, which refers to situations where future returns are unknown but follow a known distribution, uncertainty means that both the outcome and the distribution are unknown. Stocks may exhibit uncertainty when volatility or other return distribution characteristics vary unpredictably over time.

Practically, the author used a stock’s daily high and low prices to derive its volatility of volatility.

Findings

The study investigates how volatility-managed investment strategies perform under different levels of uncertainty across stocks and over time.

A new measure of volatility-of-volatility (vol-of-vol) is introduced as a proxy for uncertainty about risk, capturing a unique dimension distinct from traditional volatility.

Results show that abnormal returns from volatility management are concentrated in stocks with low uncertainty and during periods of low aggregate uncertainty.

The effectiveness of sentiment-based explanations for volatility-managed returns is conditional on the level of uncertainty.

Cross-sectional differences in uncertainty help explain why volatility-managed factor portfolios perform unevenly across stocks and time.

Theoretical analysis extends a biased belief model, showing that higher vol-of-vol reduces volatility predictability and belief persistence, weakening the benefits of volatility timing.

The study hypothesizes that volatility management is most effective for low-uncertainty stocks and in low-uncertainty market environments.

Empirical tests use realized vol-of-vol derived from intraday high and low prices as the measure of uncertainty.

Consistent with prior literature, uncertainty is positively related to future returns and contains unique predictive information not explained by other stock characteristics.

Volatility management significantly improves risk-adjusted performance in low-uncertainty stocks and during low aggregate uncertainty periods, while uncertainty also helps explain performance variation across asset pricing factor portfolios.

In short, using the volatility of volatility as a filter proves to be effective, particularly for low-uncertainty stocks.

We find it insightful that the author distinguishes between risk and uncertainty and utilizes the volatility of volatility to represent uncertainty.

Reference

[1] Harris, Richard D. F. and Li, Nan and Taylor, Nicholas, The Impact of Uncertainty on Volatility-Managed Investment Strategies (2024), SSRN 4951893

Beyond volatility of volatility

This section is written by Alpha in Academia

The Volatility of Volatility Index (VVIX) is a composite measure, driven by both short-term market panic and long-term risk expectations.

For years, the VVIX, often dubbed the “fear of fear” index, was treated primarily as a measure of the volatility of volatility (VOV), but new research reveals it contains a second, equally critical component: Long-Run Variance (LRV).

Figure 1: Time series of the squared VVIX Notes: This figure reports time series of the squared VVIX from April 4, 2007, to August 31, 2023; these are all reported on a logarithmic scale for the vertical axis, while the horizontal axis remains linear. The squared VVIX corresponds to the daily closing value retrieved from CBOE. The shaded areas indicate periods of financial distress, such as the GFC, the European debt crisis, and the COVID-19 pandemic. Note that financial distress does not correspond to the NBER recession.

Using a sophisticated model and leveraging a novel technique involving risk-neutral cumulant data extracted from VIX options, researchers decomposed the VVIX dynamics. Their analysis reveals that the factors driving the index change dramatically depending on market conditions. Specifically, the short-term panic measure, VOV, significantly contributes only during acute periods of financial distress, which aligns with intuition. However, during stable or bull markets, the VVIX is primarily driven by the LRV component, reflecting persistent, underlying risk expectations.

In fact, when testing the explanatory power on market-neutral straddle portfolios using S&P 500 options, combining LRV and VOV produced an adjusted explanatory power up to three times greater than baseline models. The finding shows that the index provides “a clear answer to the question of the informational content of the VVIX, showing that it reflects not only the VOV but also an additional important component—the LRV”. Investors should thus view the VVIX not just as a fear gauge, but as a dual-sensor monitoring immediate market stress and long-term risk.

Reference

[2] Bacon, Étienne and Bégin, Jean-François and Gauthier, Geneviève, Beyond volatility of volatility: Decomposing the informational content of VVIX, 2025, SSRN 5611090

Closing Thoughts

In summary, both studies emphasize the role of volatility-of-volatility in understanding risk and market behavior. The first shows that volatility management is most effective in low-uncertainty environments, while the second reveals that the VVIX reflects not only short-term market stress but also long-term risk expectations. Together, they suggest that volatility-of-volatility offers deeper insight into both portfolio performance and the broader dynamics of market uncertainty.

Further Reading and Discussion

For more insights on the volatility of volatility, check out the newsletter below.

Note that there is a subtle but important difference between the VIX and VVIX indices. While both are derived using similar calculation methodologies, the VIX index is based on options referencing the same underlying—the cash index—whereas the VVIX index is calculated from options on different underlyings, specifically VIX futures.

Caution is advised when designing trading and hedging strategies using VIX options. For example, a VIX call calendar spread carries significantly higher risk than an equivalent SPX put calendar.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

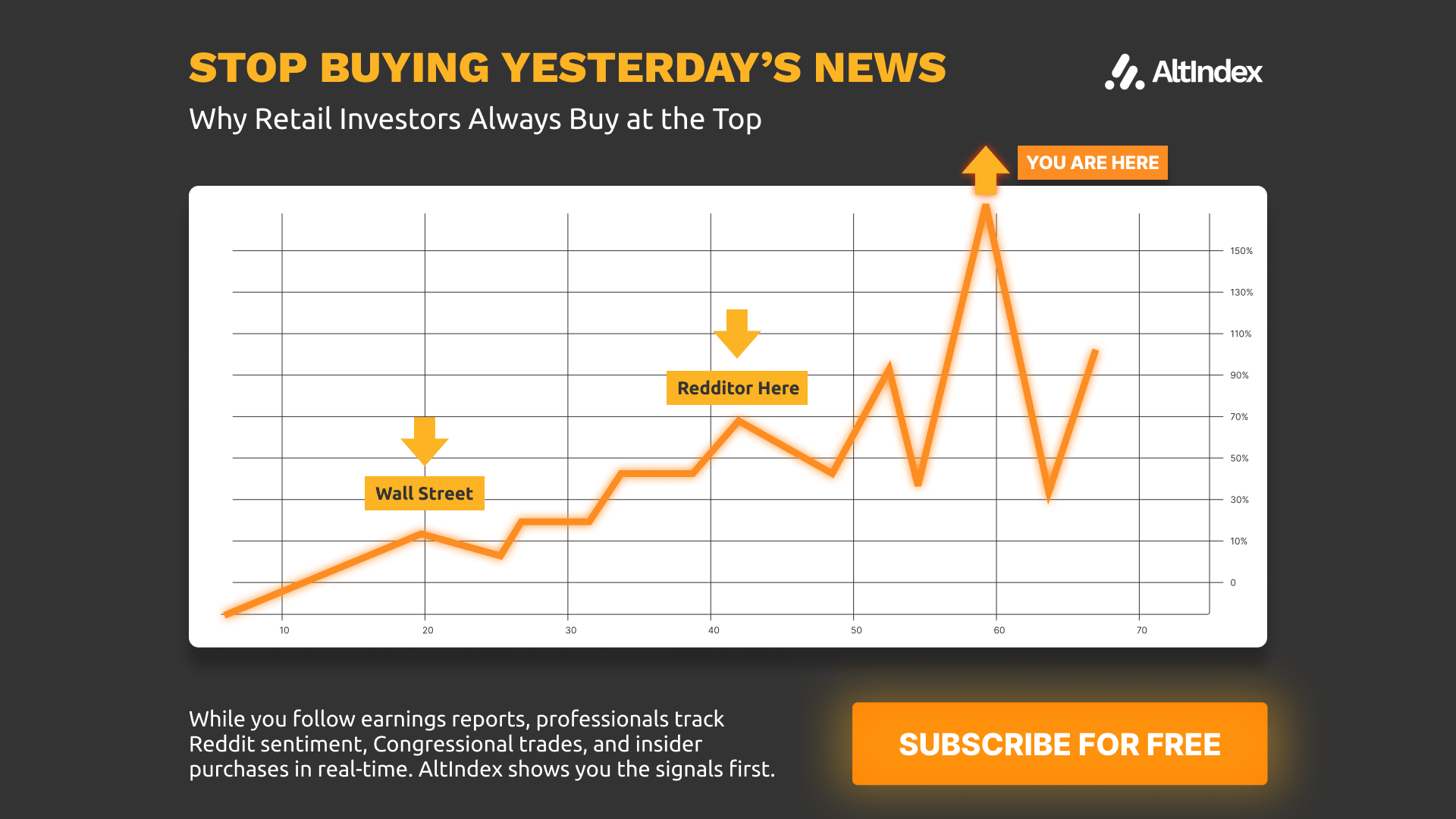

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Educational Video

Joint calibration to SPX and VIX options with signature-based models

In this video, presented at the Fields Institute, Christa Cuchiero of the University of Vienna explores joint calibration of SPX and VIX options using signature-based models. The approach draws on rough path theory and universal approximation ideas to represent model dynamics as linear functions of path signatures, providing a flexible alternative to classical stochastic volatility models. This allows both SPX and VIX options to be modeled within a single, coherent framework without relying on jumps or rough volatility.

The presentation demonstrates how volatility and price processes can be expressed through truncated path signatures, yielding tractable solutions and efficient calibration. Empirical results show that the model achieves accurate fits within bid–ask spreads for both SPX and VIX options, offering a unified and computationally efficient framework for pricing volatility-linked derivatives.

Volatility Weekly Recap

The figure below shows the term structures for the VIX futures (in colour) and the spot VIX (in grey).

The S&P 500 jumped 1.2% on Monday on optimism surrounding U.S.–China talks and continued to rise through Wednesday. The FOMC announcement then reversed sentiment, triggering an initial sell-off in equities. On Thursday, bearish momentum persisted; however, the market rebounded on Friday, supported by a positive earnings report from Amazon. Overall, the index finished the week higher.

Oil prices declined early in the week but rose on Wednesday amid renewed optimism about a potential U.S.–China trade deal. Gold prices extended their decline, marking a second consecutive down week. Bitcoin and the broader crypto market also weakened, with Bitcoin falling over 6% at one point.

On the volatility front, both spot and VIX futures rose slightly but remained in contango by week’s end. The roll yield dipped midweek before recovering to finish strongly positive. Notably, both the S&P 500 and the VIX increased simultaneously—a rare occurrence. As a result, SPY gained 0.71%, while VXX and VIXM also advanced, by 2.78% and 2.33%, respectively.

Around the Quantosphere

Wall Street’s Melt Mirage: Why Traders Are Hedging at All-Time Highs (yahoo)

Market Reversals Hit Quant Hedge Funds (hedgeweek)

Convertible Bond Boom Delivers Hedge Fund LMR’s Traders a 30% Gain (bloomberg)

Quant Trader Charged With Source Code Theft Seeks Case Dismissal (bloomberg)

How Hudson River Trading Actually Uses AI (youtube)

Hedge funds are on track for a banner year — but 2 charts show one group of money managers is the industry darling (yahoo)

All Five of His Hedge Funds Have Doubled This Year — What This Manager Is Saying Now About Gold and Tech (marketwatch)

Getting a Job at Goldman Sachs, It’s about your story (efinancialcareers)

Even ex-banking MDs can't get their children finance jobs now (efinancialcareers)

Hedge Funds Eye Retail-Driven Options and Structured Products Opportunities (hedgeweek)

London becomes ‘quant’ powerhouse as traders rake in revenues (ft)

Disclaimer

This newsletter is not investment advice. It is provided solely for entertainment and educational purposes. Always consult a financial professional before making any investment decisions.

We are not responsible for any outcomes arising from the use of the content and codes provided in the outbound links. By continuing to read this newsletter, you acknowledge and agree to this disclaimer.